Spaghetti Models in Meteorology

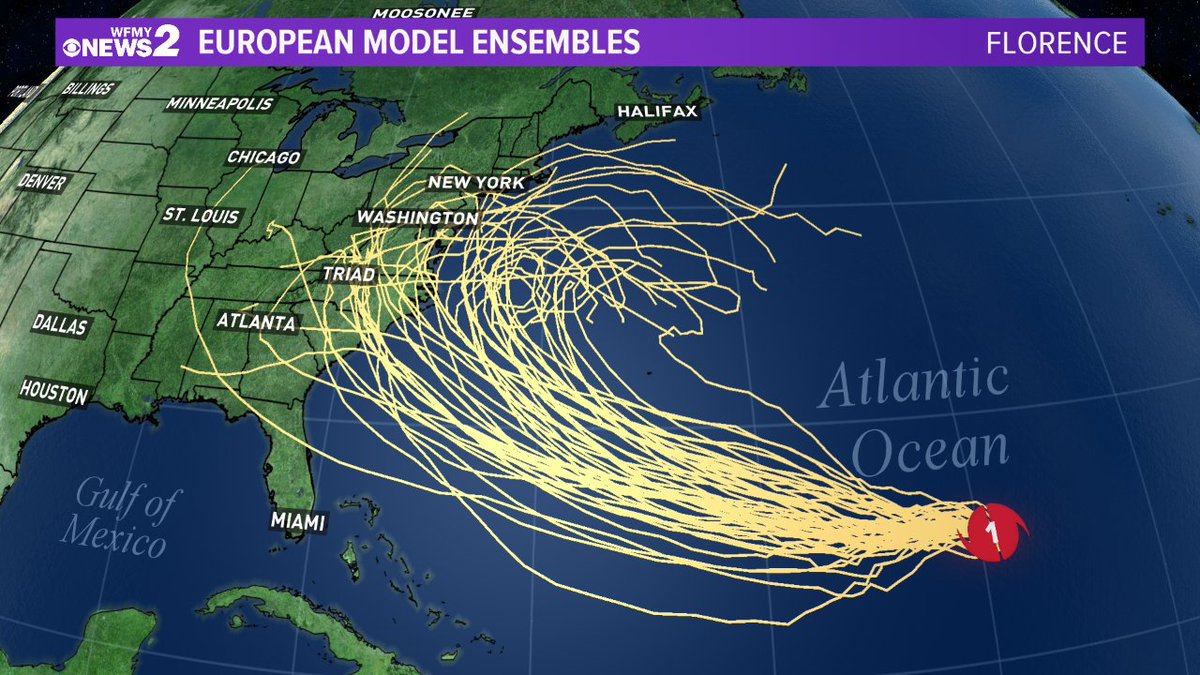

In meteorology, spaghetti models are a collection of computer simulations used to predict weather patterns. Each simulation uses a slightly different set of initial conditions, resulting in a range of possible outcomes. This range of outcomes is represented by a bundle of lines on a map, resembling a plate of spaghetti. Spaghetti models are used to provide a probabilistic forecast of future weather conditions, taking into account the uncertainty inherent in weather prediction.

Spaghetti models are useful tools for predicting the path of a hurricane. They show a range of possible paths that the hurricane could take, based on different factors such as wind speed and direction. To see the predicted path of Hurricane Beryl, click here.

Spaghetti models can help us to prepare for a hurricane by giving us an idea of where it might go and how strong it might be.

Types of Spaghetti Models

There are two main types of spaghetti models: ensemble models and deterministic models.

Spaghetti models can be useful for predicting the path of a hurricane, like Hurricane Beryl , which recently threatened Jamaica. These models use different computer simulations to create multiple possible paths for the storm, helping meteorologists make more informed forecasts.

- Ensemble models run multiple simulations with slightly different initial conditions. The resulting ensemble of forecasts provides a probabilistic distribution of possible outcomes, indicating the likelihood of different weather scenarios.

- Deterministic models run a single simulation with a specific set of initial conditions. The resulting forecast is a single, deterministic prediction of the future weather conditions.

Uses of Spaghetti Models

Spaghetti models are used to predict a wide range of weather patterns, including:

- Temperature and precipitation forecasts

- Wind speed and direction forecasts

- Storm track and intensity forecasts

- Long-range climate predictions

By considering the range of possible outcomes represented by spaghetti models, meteorologists can provide more accurate and reliable weather forecasts.

Spaghetti Models in Finance

Spaghetti models, also known as ensemble models, are a powerful tool for analyzing financial markets. They involve running multiple simulations of a financial model with different inputs or assumptions to create a range of possible outcomes. This range of outcomes is then visualized as a spaghetti-like plot, with each line representing a different simulation.

Spaghetti models are used in finance to analyze a wide range of factors, including stock prices, interest rates, and economic growth. They can be used to forecast future trends, identify potential risks, and make investment decisions.

Limitations of Spaghetti Models

While spaghetti models can be a valuable tool, they also have some limitations. One limitation is that they can be computationally expensive, especially for complex models with a large number of inputs. Another limitation is that spaghetti models can be sensitive to the choice of inputs and assumptions, which can lead to biased or inaccurate results.

Advantages of Spaghetti Models

Despite their limitations, spaghetti models offer several advantages over other forecasting methods. One advantage is that they can provide a more comprehensive view of the possible outcomes of a financial model. This can be helpful in making investment decisions, as it allows investors to see the range of potential risks and rewards.

Another advantage of spaghetti models is that they can help to identify potential risks that may not be apparent from a single simulation. By running multiple simulations, spaghetti models can show how different factors can interact to create unexpected outcomes.

Types of Spaghetti Models

There are several different types of spaghetti models used in financial analysis. One common type is the Monte Carlo simulation. Monte Carlo simulations involve randomly generating a large number of possible inputs to a financial model and then running the model multiple times to generate a range of outcomes.

Another type of spaghetti model is the scenario analysis. Scenario analysis involves running a financial model multiple times with different sets of assumptions about the future. This can be helpful in identifying the potential impact of different events, such as a recession or a change in interest rates.

Spaghetti Models in Other Fields

Spaghetti models are versatile tools used beyond meteorology and finance. They find applications in various fields, providing valuable insights and predictions.

In engineering, spaghetti models are employed to simulate complex systems, such as traffic flow or fluid dynamics. By creating multiple simulations with varying parameters, engineers can explore different scenarios and identify optimal solutions.

Environmental Modeling

Environmental scientists utilize spaghetti models to predict the behavior of ecosystems and natural processes. These models simulate factors like climate change, pollution dispersion, and species interactions, allowing researchers to assess potential impacts and develop mitigation strategies.

- Climate modeling: Spaghetti models are used to forecast future climate conditions by incorporating multiple climate models with different initial conditions and parameterizations.

- Pollution dispersion modeling: These models simulate the spread of pollutants in the environment, helping decision-makers assess the impact of industrial emissions or accidental releases.